ITPM Flash Ep38 How do you like them Apples - Summary

- The Institute Trader

- Apr 2, 2024

- 3 min read

In the ever-evolving landscape of technology and regulation, big tech companies like Apple find themselves at a crossroads. Recent developments from regulatory bodies in the United States and Europe have put these tech behemoths under the microscope, examining their practices for potential anti-competitive behavior. This scrutiny comes amidst a backdrop of changing market dynamics and internal challenges within these tech giants, particularly Apple, which has seen its share of ups and downs. Here, we delve into the factors driving a bearish outlook on Apple and explore a trade idea that capitalizes on the current market sentiment.

Setting the Scene: Regulatory Actions and Market Response

The U.S. Justice Department's Stance

On March 21st, the U.S. Justice Department announced its intention to take legal action against Apple for allegedly violating antitrust laws, specifically accusing the company of monopolizing the iPhone ecosystem. Interestingly, this announcement did not significantly shake investor confidence, as the market continues to value Apple within an unchanged tech industry landscape.

European Union's Crackdown

Conversely, the European Union fined Apple 1.8 billion for leveraging its App Store to suppress competitors like Spotify. This action is part of a broader regulatory effort to diminish the "gatekeeping" power of major digital platforms. Additionally, the EU's Digital Markets Act mandates digital gatekeepers to facilitate platform access for rival services, potentially altering the operational frameworks of companies like Apple and Microsoft.

The Underlying Issue: Antitrust Laws in the Digital Age

Antitrust regulators face the daunting task of applying industrial-era legislation to the digital age's complex landscape. Traditional methods of identifying monopolistic practices, such as dumping and price fixing, are less applicable when tech giants primarily offer free or low-cost services that, ostensibly, enhance consumer welfare through increased choice and convenience. However, regulators are shifting tactics, focusing on how tech companies' control over digital infrastructure may stifle competition and lead to predatory pricing.

Apple's Performance and Market Sentiment

The Impact of Regulatory Scrutiny

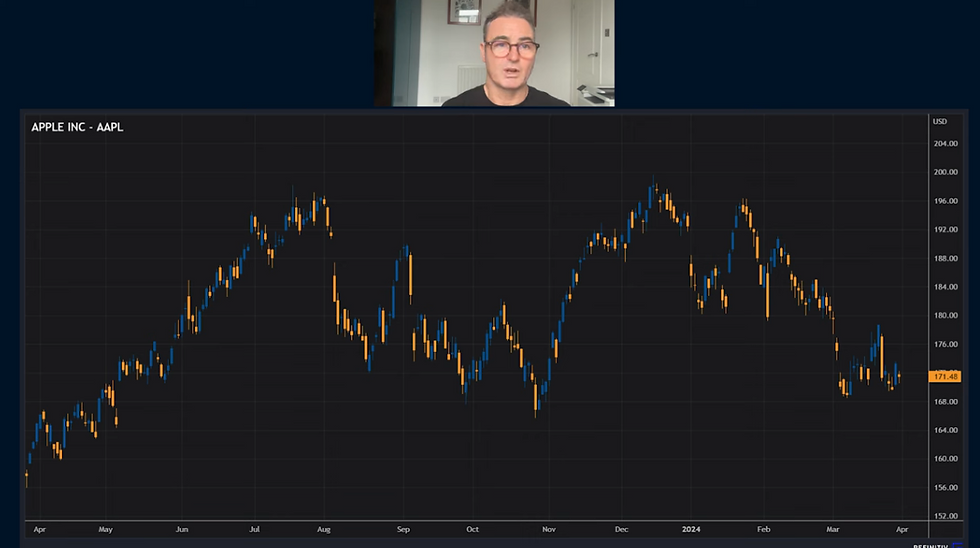

Despite the regulatory pressures, Apple's stock has underperformed, down 10% year-to-date, lagging behind major indices and its tech counterparts. This underperformance is attributed to a combination of revenue contraction, particularly from declining sales in China, waning interest in iPads, and the perceived failure to introduce innovative products.

A Trade Idea: Shorting Apple

*Given the backdrop of regulatory challenges and Apple's market performance, a bearish trade idea emerges from Jason McDonald. The aim is to capitalize on Apple's continued share price decline, influenced by both internal challenges and the evolving regulatory landscape.

(*This is not financial advice, and just a depiction of the current ITPM flash ep 38).

The Strategy Explained

*The rationale behind this trade is to leverage the anticipated depreciation in Apple's share price due to the factors discussed. By carefully selecting the strike prices and expiration dates, the trade seeks to maximize potential gains from the stock's movements, taking into account the market's price sensitivity and the aim for favourable entry points.

(*This is not financial advice, and just a depiction of the current ITPM flash ep 38).

ITPM Flash EP 38 Conclusion: A Cautious Approach

The trade idea presented reflects a nuanced understanding of the current market dynamics, regulatory environment, and Apple's position within the tech industry.

However, it's important to remember that options trading involves significant risk and requires a deep understanding of market mechanisms. Individuals should approach such strategies with caution, equipped with thorough research and possibly the guidance of financial advisors.

As the regulatory landscape continues to evolve and tech companies adapt, the market will undoubtedly offer opportunities and challenges. Navigating these waters requires a keen eye on developments and an agile approach to investment strategy.

Disclaimer

The information provided in this blog post is for general informational purposes only and is not intended to be a comprehensive guide or to provide financial advice. The opinions, insights, and suggestions mentioned herein are based on personal perspectives and should not be taken as professional financial advice. Before making any financial decisions, readers are strongly encouraged to conduct their own research and, if necessary, consult with a professional financial advisor. The author and the blog assume no responsibility for any actions taken based on the information provided in this post or any potential consequences thereof. Financial markets are volatile and can change rapidly; thus, any investments or financial strategies mentioned in this blog may not be suitable for everyone and could result in significant financial loss.